Late deals canaries: Cheap Last Minute Holidays To Canary Islands 2022 / 2023

Last minute holiday deals to the Canary islands, a beautiful jewel in the Atlantic

Luxury holidays

Last minute holiday deals to the Canary islands, a beautiful jewel in the Atlantic

Book Last Minute Deals to the Canary Islands with Voyage Prive ✅ Discover more about the wonders and beauty of these Spanish Islands. ⭐.

Visit a Europe away from Europe in the Canary Islands

This island community is prized by holiday makers as a special and unusual place, having the properties of a paradise island chain while also being very accessible casual tourism. Positioned just off the coast of Morocco, these islands experience stunning subtropical sunshine while catering to most European languages.

There’s no wonder that last minute deals to the Canary Islands are popular; there are seven large islands to choose from, each with its own flavour and virtues. From the largest island of Tenerife to the holiday favourite of Fuerteventura, there are destinations and activities available for couples and families of all ages.

Discover the varied communities of the Canaries

The various Canary Islands have a lot to offer. Tenerife is the most popular and often features in our handpicked offers. This island hosts the hugely popular southern coast resorts of Las Playa de Las Americas and Los Cristianos, which among others are varied in size and luxury, and it’s easy to hop from one to the next. They feature golden Saharan sands and a host of dining and shopping choices.

Lanzarote is another beautiful island in the chain, a popular pick for luxury holidays. The island boasts a scorching subtropical climate, even in winter, being close to mainland Africa. Costa Teguise is a fine resort on Lanzatore which boasts sandy beaches and fine dining. Shoppers will find plenty in the town itself and history buffs will love the cobbled streets and sun-kissed architecture.

The Canaries have activities for all the family

The Canaries offer a range of activities for holiday makers, such as the opportunity to climb the famous Mount Tiede on Tenerife, which is perfect for explorers and sightseers.

Whatever you enjoy, the Canaries have an island and a resort for you; sign up to browse our exclusive handpicked offers today and plan your perfect vacation.

FAQ Last minute deals Canary islands

✅ Where can I find the best deals for Canary islands at the last minute?

Voyage Privé negotiates for you the best offers at the best prices! Enjoy deals up to 70% off to go discover the Canary Islands ! You can book until the last minute, according to availability.

✅ Which hotels for a last minute stay in The Canaries ?

Rated 9,4/10 by our members, the Salobre Hotel Resort & Serenity 5* is in perfect harmony with nature and offers a full-service wellness centre, 7 outdoor pools and superb restaurants. The Volcan Lanzarote 5* is an outstanding complexe with luxurious equipment such as a solarium, private heated pool, jacuzzi, balinese beds, adults-only area,etc…

✅ How to book a stay in The Canaries at the last minute?

You just need to register online for free to be able to book one of the exclusive Voyage Privé offers! Don’t wait any longer to explore The Canaries !

✅ Which island should I choose for a stay in the Canary Islands?

Tenerife is the largest and most touristic one. You will find dense forests, sandy beaches and volcanic mountains. Fuerteventura offers dunes and sandy beaches as far as the eye can see and is particularly appreciated by surfers.

✅ What to pack for a last-minute trip to the Canaries ?

For the Canary Islands, the essential items are undoubtedly: sunscreen and sunglasses to protect yourself from the sun. Don’t forget walking boots for hiking and a jacket for windy days!

The best last-minute Canary Island holiday deals from just £119pp

- Giuli Graziano

AS the UK gets colder, Brits eager for some warmth can book a holiday abroad to get some last-minute winter sun.

And there are some amazing deals if you fancy a break in the Canary Islands – which are still above 20C during January and February.

2

Last-minute holidays to Fuerteventura can be found at bargain prices right nowCredit: Getty

This article contains affiliate links and if you click a link and buy a product we may earn revenue.

Holiday firms and airlines have brilliant travel deals for 2022 in their January sales.

TUI is offering up to £300 off on summer holidays using the code SALE, while easyJet has £300 off their holidays using BIGSALE.

Jet2 currently has a flash sale with £50 off holidays and 10 per cent off all flights here, and Thomas Cook has £50 off Spanish holidays using SPAIN50.

However, we’ve found last-minute deals to the Spanish islands from only £199pp – here are some of the best to take advantage of right now.

Tenerife

January 2022

- TUI Suneo Tamaimo Tropical apartments – 7-nights from £229pp – book now

- TUI Colon II apartments, Playa del las Americals – from £293pp – book now

- TUI GF Fanabe Hotel – 7-nights half-board from £496pp – book now

- TUI Bahia Princess Hotel – 7-nights half-board from £499pp – book now

- TUI Bahia Principe Hotel – 7-nights all-inclusive from £599pp – book now

February 2022

- Jet2 Holidays Columbus Aparthotel, Playa del las Americas – 7-nights half-board from £399pp – book now

- Jet2 Holidays Hard Rock Tenerife Hotel – 7-nights from £699pp – book now

- Jet2 Holidays Paradise Park Hotel, Los Cristanos – 7-night half-board from £496pp – book now

- Thomas Cook Laguna II Apartments, playa del las Americas – 7-nights from £199pp – book now

- Thomas Cook Iberostar Las Dalias Hotel – 7-nights all-inclusive from £561pp – book now

- EasyJet Holidays Gran Oasis Resort – 7-nights all-inclusive from £599pp – book now

- EasyJet Holidays Malibu Park apartments – 7-nights from £363pp – book now

Most read in NEWS TRAVEL

GOING ALL IN

Best all-inclusive hols to sunny destinations from £42pp a night in October

BEACH YOU TO IT

Bag Spain beach hols from £23pp a night as travel restrictions get scrapped

RIGHT MALDIVA

Maldives holiday resort which is perfect for families & EVERYTHING’S included

SEAS THE DEALS

Crazy cheap beach hotel rooms from £10pp a NIGHT this winter

Lanzarote

January 2022

- TUI The Morromar apartments – 7-nights from £288pp – book now

- TUI Paradise Island – 7-nights all-inclusive from £399pp – book now

- TUI h20 Timanfaya Palace Hotel – 7-nights half-board from £470pp – book now

- Jet2 Holidays Sandos Papagayo Hotel – 7-night half-board from £599pp – book now

- Jet2 Holidays Beatriz Costa Hotel – 7-nights bed and breakfast from £353pp – book now

February 2022

- Thomas Cook Blue Sea Costa Bastian apartments – 7-nights from £219pp – book now

- Thomas Cook HL Club Playa Blanca – 7-nights all-inclusive from £399pp – book now

- EasyJet Holidays Costa Teguise Playa Hotel – 7-nights half-board from £547pp – book now

Gran Canaria

January 2022

- TUI Monte Feliz apartments – 7-nights from £288pp – book now

- TUI Hotel Paradise Lago Taurito – 7-nights all-inclusive from £449p – book now

February 2022

- Jet2 Holidays Servatur Don Miguel, Play del Ingles Hotel – 7-nights from £399pp – book now

- Jet2 Holidays Colina Mar Aparthotel, Puerto Rico – 7-nights from £349pp – book now

- Thomas Cook The Lago Taurito Hotel – 7-nights all-inclusive from £424pp – book now

- EasyJet Holidays Mirador Maspalomas by Dunas – 7-nights all-inclusive from £399pp – book now

- EasyJet Holidays Cala d’or apartments, Puerto Rico – 7-nights from £399pp – book now

Fuerteventura

January 2022

- TUI Oasis Dunas apartments, Corralejo – 7-nights from £299pp – book now

- TUI Riu Olivia Beach Resort – 7-nights all-inclusive from £399pp – bok now

- Jet2 Holidays Elba Castillo San Jorge & Antigua Suite Hotel – 7-night half-board from £399pp – book now

February 2022

- Thomas Cook Club Costa Caleta apartments – 7-nights from £199pp – book now

- EasyJet Holidays Labranda Aloe Club – 7-nights all-inclusive from £454pp – book now

The Canary Islands are open to Brits – however, all arrivals over 12 must be fully vaccinated and provide proof upon arrival.

Holidaymakers must also fill out the Spanish Health Form before travelling.

Some resorts and airlines may require you to present proof of a negative Covid test, so it’s worth double-checking before leaving.

Face masks must be worn in public spaces such as restaurants, bars, and tourist attractions by anyone over the age of six.

2

The Hard Rock Hotel in Tenerife is offering seven nights from £699pp this FebruaryCredit: HARD ROCK CAFE

This article and featured products have been independently chosen by Sun journalists. It contains links that are ads, and if you click a link and buy a product we will earn revenue.

Topics

- Deals and sales

- Travel Deals

- Travel ecomm

- Canary Islands

- Gran Canaria

- LANZAROTE

- Tenerife

Last Minute Holidays to Tenerife | Canary Island Sunshine

News & Latest Offers

Sign up

Call our experts on

0800 412 5292

-

Destinations

-

Holiday Types

-

All Inclusive -

Package Holidays -

Winter Holidays -

Ski Holidays -

City Breaks -

Summer 2022 -

Summer 2023 -

UK Breaks -

Pay Monthly Holidays -

Late Deals -

Lakes and Mountains

-

-

Cruise Holidays -

Faraway Holidays -

Covid Advice -

My Booking

-

Spain -

Canaries -

Turkey -

Greece -

Portugal

More Destinations

keyboard_arrow_right

-

Benidorm -

Costa Del Sol -

Costa Dorada -

Majorca -

Ibiza -

Menorca

Top Destinations in Spain

View Spain

keyboard_arrow_right

-

Tenerife -

Lanzarote -

Gran Canaria -

Fuerteventura

Top Destinations in Canaries

View Canaries

keyboard_arrow_right

-

Marmaris -

Icmeler -

Alanya -

Bodrum

Top Destinations in Turkey

View Turkey

keyboard_arrow_right

-

Corfu -

Zante -

Rhodes -

Kos -

Santorini -

Crete -

Skiathos -

Halkidiki

Top Destinations in Greece

View Greece

keyboard_arrow_right

-

Albufeira -

Vilamoura -

Praia Da Rocha -

Madeira

Top Destinations in Portugal

View Portugal

keyboard_arrow_right

Don Pancho

Benidorm, Costa Blanca

airplanemode_activeSelected airports

£329pp

More Details

keyboard_arrow_right

HOTEL CLUB SIROCO

Costa Teguise, Lanzarote

airplanemode_activeSelected airports

£479pp

More Details

keyboard_arrow_right

Side Star Elegance

Side, Turkey

airplanemode_activeSelected airports

£485pp

More Details

keyboard_arrow_right

MORFEAS HOTEL & APARTMENTS

Kavos, Corfu

airplanemode_activeSelected airports

£245pp

More Details

keyboard_arrow_right

Tropical Sol

Albufeira, Algarve

airplanemode_activeSelected airports

£269pp

More Details

keyboard_arrow_right

menu

Menu

close

Destinations

keyboard_arrow_right

Spain

keyboard_arrow_right

Benidorm

Costa Del Sol

Costa Dorada

Majorca

Ibiza

Menorca

View Spain

Canaries

keyboard_arrow_right

Tenerife

Lanzarote

Gran Canaria

Fuerteventura

View

Canaries

Turkey

keyboard_arrow_right

Marmaris

Icmeler

Alanya

Bodrum

View Turkey

Greece

keyboard_arrow_right

Corfu

Santorini

Zante

Rhodes

Mykonos

Crete

View Greece

Portugal

keyboard_arrow_right

Albufeira

Vilamoura

Praia Da Rocha

Madeira

View

Portugal

View All

keyboard_arrow_right

Holiday Types

keyboard_arrow_right

Cruise HolidaysFaraway HolidaysCovid AdviceMy Booking

Sun-worshippers will love a last-minute holiday to Tenerife.

Whether you’re planning a family getaway or couples retreat, we can help you find your perfect late deal to Tenerife. You’ll be spoilt for choice when holidaying in Tenerife, with a number of exciting resort towns to choose from.

The island’s south coast boasts a number of favourite spots, including Playa Las Americas, Costa Adeje and Los Cristianos. If you’re looking for some peace and quiet then head north to explore some hidden gems such as the sea views from Santa Ursula and La Laguna’s idyllic old town.

The more adventurous holiday makers should pay a visit to Mount Teide, Spain’s highest point. The volcano is safely accessible by guided tour and makes for a worthy hike to the panoramic views.

Enjoy the break you deserve and book a last minute getaway to Tenerife online today with Hays Travel. Alternatively, come and visit us at your local Hays Travel store.

Canaries Holidays from £91 | Cheap All Inclusive Deals 2022-2023

Canaries Holiday Deals

From £91 per person

| Date | Prices From | All Inclusive |

|---|---|---|

| Sep 2022 | £118 | £198 |

| Oct 2022 | £111 | £194 |

| Nov 2022 | £91 | £193 |

| Dec 2022 | £99 | £188 |

| Jan 2023 | £110 | £206 |

| Feb 2023 | £139 | £222 |

| Mar 2023 | £137 | £224 |

| Apr 2023 | £126 | £218 |

| May 2023 | £137 | £214 |

| Jun 2023 | £153 | £229 |

| Jul 2023 | £170 | £270 |

| Aug 2023 | £173 | £289 |

| Sep 2023 | £170 | £269 |

The Canary Islands are a wonderful holiday destination whose benevolent climate welcomes visitors throughout the year.

One of the attractions of a Canary Island holiday is that it provides winter warmth for sun-starved Britons without necessitating a long haul flight. This is a great advantage for those travelling with young children. The islands offer a diverse range of accommodation from top of the range all inclusive hotels and luxury villas to apartments on room only basis, thus ensuring that they cater for all budgets.

The Canary Islands have a plethora of eateries from fast food and pub grub to first class restaurants that cater for all tastes and pockets. Every island has its own selection of tourist attractions and recreational facilities so there is always plenty to keep you entertained. You can choose from banana boating, surfing, sailing, water skiing and fishing. You can go whale and dolphin watching or big game fishing. Tourist attractions include water parks and amusement parks, bird and animal sanctuaries, camel and horseback riding, national parks and cave explorations.

Canary Island holidays can be as active or as relaxed as you wish as there are resorts to suit all age ranges and interests.

Many regional airports offer flights to the Canary Islands. You can search for holidays from your local airport on the Cheekytrip website.

Save yourself time and money and find the best deals on Canary Island holidays on the Cheekytrip price comparison site. With over three dozen travel companies competing for your custom, you are assured of the best deal. To use our search engine, simply enter your point of departure, your destination and your dates and within a few seconds, we’ll find you the holiday that offers the best value for money. All you have to do is make a phone call. Offers change daily so if you wish to avoid disappointment, book today.

Related Pages

- Canary Islands

- Fuerteventura

- Gran Canaria

- La Gomera

- La Palma

- Lanzarote

- Tenerife

- Holidays

- Balearic Islands

- Bulgaria

- Cape Verde

- Caribbean

- Costa Rica

- Croatia

- Cyprus

- Egypt

- Gambia

- Greece

- India

- Indonesia

- Italy

- Malaysia

- Maldives

- Malta

- Mauritius

- Mexico

- Montenegro

- Morocco

- Portugal

- Seychelles

- Spain

- Sri Lanka

- Thailand

- Tunisia

- Turkey

- United Arab Emirates

- United States of America

Share this article

Advertisement

Advertisements

Subscribe To Our Holiday Deals Newsletter

Enter your email address and we’ll send you a selection of our top holiday deals each week.

This site is protected by reCAPTCHA and the Google

Privacy Policy and

Terms of Service apply.

Short HaulLong HaulSkiCity Break

Where would you like to go?

Departure Regions

All Northern

All Southern

All London

All Midlands

All North East

All North West

All Yorkshire

All East Anglia

All South Coast

All West Country & Wales

All Northern Ireland

All Scotland

Local Departure Airports

Aberdeen

Belfast

Belfast City

Birmingham

Bournemouth

Bristol

Cardiff

City of Derry

Doncaster Sheffield

Durham Tees Valley

East Midlands

Edinburgh

Exeter

Glasgow

Glasgow Prestwick

Guernsey

Humberside

Inverness

Isle of Man

Jersey

Leeds Bradford

Liverpool

London City

London Gatwick

London Heathrow

London Luton

London Southend

London Stansted

Manchester

Newcastle

Newquay

Norwich

Southampton

Duration

Any Duration1 Night2 Nights3 Nights4 Nights5 Nights6 Nights7 Nights8 Nights9 Nights10 Nights11 Nights12 Nights13 Nights14 Nights15-20 Nights21 NightsOver 21 Nights

Date Flexibility

Exact Date+/- 1 Day+/- 2 Days+/- 3 Days+/- 5 Days+/- 7 Days

Board Basis

Any Board Basis

All Inclusive

Bed & Breakfast

Full Board

Half Board

Room Only

Self Catering

Catered

Min Star Rating

Any1+ Star2+ Stars3+ Stars4+ Stars5 Stars

More Search Options

Direct Flights Only

Low Deposits Only

Price Range (Per Person)

Any PriceUnder £250£250 – £500£500 – £750£750 – £1000£1000 – £1500Over £1500

Sort by

Lowest Price FirstHighest Price First

We use cookies to make your experience on our site even better and to offer you the best experience online.

By clicking ‘Accept all’ you’re agreeing to our use of cookies. You can change your cookie preferences by choosing ‘Manage settings’. If you want to know more you can read our privacy & communication policy.

Manage Settings

You can manage your cookie preferences in the sections below.

We use these cookies to maintain our web pages and for testing new features. These cookies are always active.

Analytics and Tracking

We use these to understand how you use our website and services while on our page. This data is used to measure how many people visit each page, and what options they click on. We will only use these cookies if you give us consent.

Marketing Cookies

We use these cookies to pick and show adverts that we think you would like to see, alongside our partners. They also let us measure how effective they are by checking the type of adverts and how often they are shown, as well as how you interact with them.

Last Minute Holidays in Lanzarote

-

HomeToGo: Holiday lettings & cottages

-

Spain

-

Canary Islands

-

Isla de Lanzarote

-

Last Minute Deals in Lanzarote

Choose the perfect holiday letting

Best holiday rental deals in Lanzarote

Last Minute Deals in Lanzarote: Top Holiday Lettings

The Weather in Lanzarote

– Rainy days

Frequently Asked Questions

How much does holiday accommodation for Last Minute Deals in Lanzarote cost?

By using HomeToGo, you can find prices as low as £43 per night when it comes to holiday accommodation for Last Minute Deals in Lanzarote.

What types of holiday accommodation are available for Last Minute Deals in Lanzarote?

To find accommodation and complete the planning for Last Minute Deals in Lanzarote, browse our top-notch selection of available House rentals and Apartment rentals.

Average Nightly Rental Prices in Lanzarote

Holiday Letting Price Information in Lanzarote

Holiday Rental Availability in Lanzarote

Holiday Home Availability Information in Lanzarote

Travel tips, inspiration and ideas for holidays in Lanzarote

Find holiday inspiration for your next trip

-

Holidays with Toddlers

-

Stay in a Castle

-

The Best Music Festivals in Europe

-

Nature Holidays

-

Cabins & Lodges

-

Adventure Holidays for couples

-

Chalets

-

ecotourism

-

Holiday Cottages with Pools

-

New Years Eve Getaways

Last minute holidays in The Canaries – Holiday deals

Last minute holidays in The Canaries – Holiday deals | Pierre & Vacances

Loading, please wait.

Free cancellation

payment in up to 4 installments

Best price guaranteed

Find a lower price elsewhere, we’ll refund the difference

Secure payment

Pay in two installments without any extra fee

- Home

- Last minute Spain

- Last minute The Canaries

Type of destination

Seaside 5

Activities

Outdoor pool 4

Children’s clubs 3

Wellness centre 2

Water park 1

Indoor pool 1

Relaxation area 1

Play area 4

Water sports 1

Golf 3

Horse riding 1

Fitness 2

Tennis 5

Services

Pets allowed 2

Wi-Fi available in the accommodation 4

Car park 4

Free Baby equipment 3

Breakfast 3

Breakfast included 1

Bread and pastries delivery 1

Half-board 2

Full board 1

Launderette 4

24-hour reception 4

Air conditioning 1

Brand

Pierre & Vacances 3

Pierre & Vacances Villages 1

Pierre & Vacances Premium 1

Destinations

Fuerteventura 1

Lanzarote 2

Tenerife 2

Loading, please wait.

Free cancellation

payment in up to 4 installments

Best price guaranteed

Find a lower price elsewhere, we’ll refund the difference

Secure payment

Pay in two installments without any extra fee

The Canaries :

5 results from €372 for 7 nights

Sort by popularityLow to high priceHigh to low priceBy rating

- Villages

- Residences

- Premium residences

- Hotels

- Aparthotels

Holiday Village Fuerteventura Origo Mare

Idyllic beaches and volcanic landscapes

Water park

Wi-Fi available in the accommodation

Air conditioning

Pets allowed

Car park

7 nights

from Thur 22 Sept

to Thur 29 Sept 2022

from

€742

The price shown is per accommodation, for a Villa Superior 4 people – 1 bedroom – Terrace from Thur 22 Sept to Thur 29 Sept 2022 .

Partner

Premium residence Regency Country Club

Your residence has a large swimming pool with a panoramic view

Outdoor pool

Wellness centre

7 nights

from Sun 25 Sept

to Sun 02 Oct 2022

from

€1,338

The price shown is per accommodation, for a Apartment Standard 3 people – 1 bedroom from Sun 25 Sept to Sun 02 Oct 2022 .

Partner

Residence Caybeach sun

Lots of activities in unspoilt natural surroundings

Indoor pool

Outdoor pool

Wi-Fi available in the accommodation

Car park

7 nights

from Tue 11 Oct

to Tue 18 Oct 2022

-5%from

€623

€592

€623

The price shown is per accommodation, for a Apartment Standard 2 adults – 1 bedroom from Tue 11 Oct to Tue 18 Oct 2022 .

Hurry, only 5 available

Hurry, only 5 available

Partner

Residence Marazul del Sur

Residence overlooking the sea

Exotic vegetation to discover.

Exotic vegetation to discover.Outdoor pool

Wi-Fi available in the accommodation

Pets allowed

Car park

7 nights

from Sat 24 Sept

to Sat 01 Oct 2022

-10%from

€413

€372

€413

The price shown is per accommodation, for a Apartment Standard 4 people – 1 bedroom from Sat 24 Sept to Sat 01 Oct 2022 .

Hurry, only 1 available

Hurry, only 1 available

Partner

Residence La Bocayna

Your residence with a sea view.

Breakfast included

Outdoor pool

Wi-Fi available in the accommodation

Car park

Wellness centre

7 nights

from Sun 25 Sept

to Sun 02 Oct 2022

from

€2,513

The price shown is per accommodation, for a Apartment Standard 4 people – 2 bedrooms – Breakfast included from Sun 25 Sept to Sun 02 Oct 2022 .

We propose other residences which are available near your destination :

Please wait…

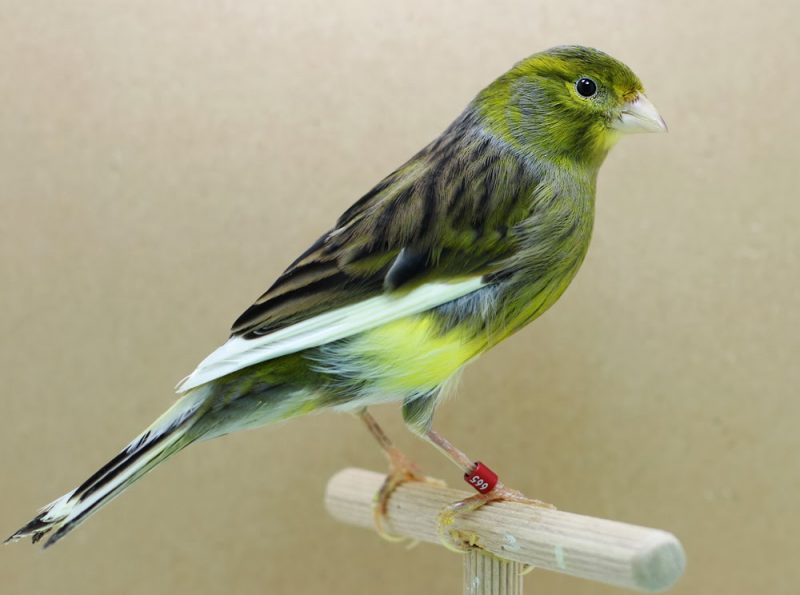

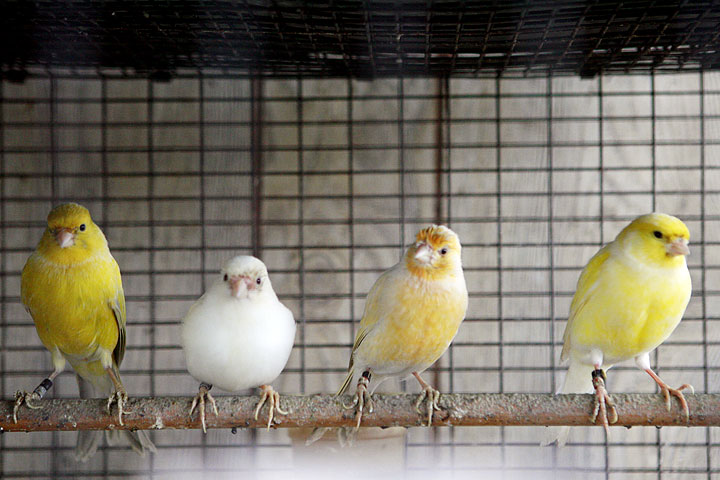

Canary singing example – AST partner

Canary singing example

This site is dedicated to RUSSIAN CANARY. Lovers of bird singing will find friends and like-minded people here. By sending your materials, you can become our co-authors. Everyone can start a new topic and ask any question about birdsong.

To quickly find the information you need, enter the word you are looking for in the search box (at the top of the page).

| News: Article by V. Yu. Ivanov “About our Russian canaries.” Based on forum posts. Edited by A. V. Razuvaev. Read more. |

| Russian canary: V.Yu.Ivanov shares the experience of a canary breeder. Based on materials from the posts of Ivanov V. Yu. (Anapa). Editing and proofreading by A. V. Razuvaev. Read more. |

| News: Article by A.  Yankovsky “The Crisis of the Russian Singing Canary” Yankovsky “The Crisis of the Russian Singing Canary” By posting the article in the author’s edition, the FPRK does not share the author’s position on many issues. A. Yankovsky has recently started to train Russian canaries and has no experience of participating in competitions. We hope that the author will be able to demonstrate his views on the development of the song of the Russian canary not only in theory, but also in practice. Read more. |

| News: 6th Spring Singing Competition in Moscow We invite you to take part in the next competition! Nonresident – benefits! Read more. |

| Russian canary: Myths and reality. The article discusses the problems of training young males and possible ways of developing domestic canary breeding. More. |

| News: Exhibition of song breeds of canaries On December 11-12, an exhibition of canaries takes place in the expo center of Sokolniki Park More.  |

| News: Canaries for sale What you need to know about canaries before buying. Read more. |

| Singing: Birds and music Article by Natalya Kameneva More. |

| Russian canary: Continuation of the story about V. P. Goncharov Moscow historian A.A.Alexandrov about the translator of the book “Dutch Canary” V.P.Goncharov More. |

| Russian canary: Historiography of the Russian canary New information about pre-revolutionary societies More. |

Russian Canary Support Fund

Site of the RUSSIAN CANARY SUPPORT FUND WWW. ENG-CANARY. RU has existed since September 2003. In October 2006, its modernization was made. The previous version is here.

The Russian Canary Support Fund is a non-profit organization. It exists since 2000, in 2005 it was registered as a legal entity.

Founder of the Foundation A. V. Razuvaev,

President of the Foundation R.

Canary Breeding Consultants:

I. A. Nikonov.

A. G. Starchenko.

E. A. Chibizov.

Music consultants:

Composer A. I. Kiselev,

Composer A. O. Strelnikova.

Scientific consultants ornithologists: Doctor of Biological Sciences, Professor G. N. Simkin.

Doctor of Biological Sciences, Professor I.R. Boehme.

Technical and moral support:

Journalist, photographer Yu.

Once again about the song of the Russian canary

Most of the modern publications on canaries in Russian tell in detail about the origin, breeds, keeping, breeding, treatment. These texts move smoothly from one book to another, but it is almost impossible to find materials on singing in them. The reasons for this are in the fluidity, constant movement and variability of both the tastes of the breeders of the Russian canary, and in the work of the performers themselves, who are constantly changing something in the song. The same thing happens with the examination of singing at competitions.

How did the tribes “roller”, “pipe”, “bell”, “seagulls” mentioned in ancient texts sound 100 years ago? One can only hope that the old phonograph records are not all lost, and that modern canaries will have a chance to hear the voices of history. The work on creating a Russian canary song library seems to be the most important thing in domestic canary breeding today, also because the development of the song reflects the formation of national musical culture. The song of the Russian canary with its secrets of learning, the selection of teachers from among the outstanding forest singers, the best-sounding bells, bells, the manufacture of special pipes – “pipes”, which are a special art to play, should undoubtedly become the subject of the most serious historiographic research.

Roman Skibnevsky

Founder of the Fund A.

Rus-canary. ru

15.05.2019 18:43:16

2019-05-15 18:43:16

Sources:

Https://rus-canary. ru/

9. Teaching canaries to sing / Canaries » /> » /> .keyword { color: red; }

An example of a canary singing

9.

Domestic canaries can sing all year round, but they also have their singing season. It usually starts at the end of November. By December, their voice already sounds in full force, but the best singing can be heard from February-March and throughout the spring. At the end of summer and autumn, birds molt, during which they sing very weakly.

Canary male sings. The singing of a female can be heard very rarely, besides, it is not very beautiful, contains many flaws and does not last long.

Male canaries truly have unique vocal abilities. They not only skillfully imitate the singing of other birds, but also imitate human speech, and also reproduce musical phrases played on musical instruments, and even whole melodies. Some kenars are real virtuosos in this area.

Over the years, canary breeders have carried out breeding work aimed at improving the natural abilities of canaries. As a result, significant results have been achieved.

All this became possible due to the fact that representatives of many breeds of canaries, in particular the Harz canary, can inherit their singing abilities. Their song, as a rule, consists of several rounds, or knees, which are often performed in a special, strictly established sequence.

However, canaries also need to be trained to sing. A bird may have an excellent heredity, but not be a good singer. In order for a canary to flawlessly perform a song that meets the breed standard, it must be trained long and hard.

In the singing of kenars, in addition to the song itself, its structure and quality of performance, the voice of the bird is also evaluated. Rattling should not be heard in it, and individual notes should not be flashy, loud and sharp. Pure, strong, sonorous and at the same time gentle voices are most highly valued.

Good singers should have at least 10–12 knees in their song. The best of them perform up to 14-15 different tours.

Not all canaries have the same singing ability.

Bad singers also pass on their mediocrity. Not very capable are mixed species of kenars obtained from different song breeds, no matter how great singers their parents may be.

Singing is usually taught to young kenars. This is a very complex process that requires a certain skill and a good musical ear from the teacher. A very important condition in the process of training a bird is also the correct maintenance and feeding. For example, the development of singing skills is facilitated by the transplantation of males from a passage cell into small single cells measuring 35 × 25 × 18 cm, and they should be transplanted immediately after the end of the molt.

When transplanting each of the kenars, it is necessary to inspect, inflating the feathers on the breast and abdomen. It is very important to establish the physical condition of the bird – whether there are excessive fat deposits or excessive thinness with a protruding chest, etc. fatness. This factor is considered favorable for the development of singing.

Some birds that have lived in the same cage for some time get used to being together, and at first they refuse to sing at all when separated. In this case, for the first 1–2 weeks, cages with birds should be placed side by side so that they can see each other.

When the males get used to sitting alone, their cages are placed one above the other, and the rows are blocked with cardboard so that the birds do not see each other. From this time they can begin to train.

Previously, special bird organ and various musical instruments – pipes, flutes, etc. were used to teach canaries to sing. Currently, electronic recordings of the best canary singers are used.

At the same time, the live singing of “teachers” is still considered to be the best way of learning, which should be selected in advance for young kenars. Experienced canary breeders are very careful in this matter. The fact is that only the best singers are suitable for training, but finding them, all the more so, is not very easy to get. Kenars with outstanding abilities are very rare and, as a rule, are not available to a wide range of owners. In this regard, the “teachers” are often allowed canaries, which have small errors in singing, such as high whistles or small wheezing.

Birds learn best from their father. However, if such a canary sings with many errors, and there is simply no way to find another good singer, it is recommended that the young male be left to develop himself, since he inherited the main features of the singing of his breed. On this basis, the kenar can independently create a song characteristic of a given tune. The new song may differ somewhat in content and be significantly inferior to the song of the trained bird, but it will have less marriage.

The main skill of the kenar is the clear execution of the knees of the song with smooth transitions. The “teacher” must perform his song without dissonances that any student can learn and then repeat.

The main teaching method is most often open. It lies in the fact that cells with males are arranged in one or more rows. In each vertical row, birds must be fenced off from each other with cardboard or plywood. It is believed that, without seeing each other, males will behave more calmly, less excited or excited, and the result will be more even and longer singing.

All cages containing trained kenars must be rectangular and of the same size. The cells with the very first brood are placed in the upper row, and the cells with the males of subsequent generations are placed in the lower row. The cell with the “teacher” is placed opposite the cells with the “students” so that they can see him. There should not be birds of other breeds in the room, otherwise notes of other tunes will appear in the singing of kenars, as a rule, spoiling a good song.

In the first weeks, the cages with the birds to be trained are slightly darkened. To do this, you can use blue, green or blue curtains. Some amateurs darken the entire room by curtaining the windows, but in this case, the cage with the “teacher” should be on the windowsill behind the curtain, without losing sunlight.

Birds can be placed differently in the room. To do this, use a special educational cabinet in which you can place any number of “students”. There are many individual cells arranged in the cabinet, their back walls and front doors are glazed with frosted glass. Holes should also be drilled on the rear walls of the cells to allow fresh air to enter.

In the absence of the study cabinet described above, an ordinary bookcase can be used instead, which is divided into the required number of cells and doors are attached to each.

In any case, the amount of light entering the pupils’ cages is controlled by opening and closing the cage doors. Changing the intensity of light, in turn, is one of the important means used in the learning process.

Educational cupboard for teaching canaries singing

As mentioned earlier, the cage with the “teacher” is installed opposite the cupboard that contains the “students”, or in one of the upper cells of this cupboard. Poorly singing birds should be placed closer to the “teacher”, which will contribute to the better formation of their voices. The canary breeder must watch the singing of his pets every day and periodically listen to them. When sharp and loud trills appear in the singing of young kenars, he enhances them by darkening them so that the birds themselves sing quieter and better listen to the teacher’s singing.

Over time, the incoherent sounds of young males, still completely different from beautiful harmonious singing, are transformed into separate knees – components of their future song.

The first audition of kenars takes place about a month after the start of training. To do this, they are released one by one from a darkened cage or placed in a separate bright room, where they have the opportunity to sing freely for 30–40 minutes.

If a specialist finds errors and distortions in a bird’s song, the cage is immediately darkened, stopping singing. If these shortcomings are not corrected during the next auditions, the kenar is rejected as a singer.

After listening to all the kenars, their cells should be rearranged. Males gather in separate groups, in the singing of which an approximately common set of knees is manifested. Thus, the birds are divided by tunes, in accordance with the developed inclinations. Arranged in this way, the cages will help the canary breeder to achieve the best coherence in the singing of birds and, as a result, the stability of their singing.

When the various songs are finally formed, the cells with the canaries begin to darken at the same time, so that they sing better among themselves and further consolidate their tune. The song of the trained canary is finally formed by about 7-8 months of age. Cells by this time cease to darken.

Self-taught singers form their own song, which takes much more time.

Young, newly formed singers can already be used as assistants to the lead singer when training the later brood. But, first you need to make sure that the new singer really correctly adopted the teacher’s song and constantly maintains her plan.

The plan or structure of the song is the constant alternation of knees in a certain order. This alternation should be correct and harmonious, and the transitions from one knee to another should be soft. In addition, the singer must perform the entire song at once from beginning to end and without stopping.

It is considered a very beautiful technique when a canary, having completely sung the whole song, repeats its second half.

Using musical instruments

To teach canaries to sing with the help of musical instruments, special air whistles are currently used, which reproduce the sound of various scatterings.

The main part of this whistle is a soft sheet tube. The shorter and narrower it is, the higher the sound produced will be. Its volume is regulated by covering the top of the handset.

At a distance of 2 cm from the upper end, a hole with a diameter of 2-3 mm is drilled, into which a beeswax partition or cork of the appropriate diameter and a length of 4-6 mm is inserted. The partition inserted over the edge of the tube must reach the cut hole.

Attached to the bottom of the tube is a special reservoir filled with water. When it is empty, the whistle sounds like a non-vibrating scattering. Such sounds are used to teach birds to sing. A tank filled with water to a certain level gives the whistle the sound of a vibrating placer.

Use of electronic recording

This method involves the use of recordings of the best canary singers. This method is convenient in that it does not require the presence of the “teacher” bird itself, which is very difficult to find. A high-quality recording may well replace a Kenar singer.

Teaching canaries with such records is currently the most common method in the West. However, such training does not always end successfully, since this technique has not yet been fully developed.

For Russian canary breeders, recordings of songs by good singers are often inaccessible due to high cost. In addition, owners of birds with a beautiful tune are usually reluctant to share their art with other canary breeders, wanting to preserve the uniqueness of their pet’s singing and sole ownership of a particular tune. As a result, the birds disappear without transferring their skills to any canaries, or they pass into the private hands of wealthy owners who acquire the bird rather just for fun, not caring about the development of the singing art of canaries.

For those who have the opportunity, some recommendations are offered for recording canary singing and using it in teaching:

from learning and, worst of all, may be included in the song of the kenar;

› the song of the kenar must be recorded several times in a row – subsequently, from these recordings, the most pure in sound and correct in performance is selected, or a montage is made from a set of separate knees assembled in a certain order;

› it is possible to combine 2 different songs in one recording, but this is very difficult;

› the best time to start teaching canar using notes is in the morning;

› after each song, it is necessary to make an interval of at least 10 seconds – during this pause, the call of the kenar is inserted;

› the student must listen to the recording for at least 40-50 minutes 4 times a day;

› Recordings are recommended to be used only at the initial stage of learning, as well as to improve the song of the leading kenar so that he does not forget the plan of the song.

Pupils with a good heredity easily perceive a recorded and played song, even if it is very complex in content. However, when they come out in full voice, it is necessary to move from the records to the canary teacher.

It is useful to record the leading kenar during the molting of males, when they seldom sing. In addition, it is used in the case when a male is acquired with a song plan that has not yet been fixed.

If all the described actions are correctly performed, the result will be sure even if the breeder has no previous experience in teaching canaries to sing.

Study cabinet for teaching canaries to sing

However, when they come out in full voice, it is necessary to move from the records to the canary teacher.

www. plasma. ru

10.08.2017 15:11:56

2017-08-10 15:11:56

Sources:

Http://www. plasma. ru/homepet/kanareiki/p10.php

FORUMS for canary lovers. • Browse the forum — I will give, accept as a gift, exchange » /> » /> .

An example of a canary singing

Forum Rules

General provisions of the Sell section

Rules come into force on December 1, 2011

This section is intended for any announcements related to the sale of birds and goods on the subject of the forum.

Conditions for placing ads

• An ad for the sale of 1-2 birds can be placed free of charge by any user who has written at least 10 messages. Such an ad can be placed no more than 1 time in 3 months.

• Members of the “Russian Canary” club can place free ads for the sale of 1-2 birds once a month … And also post ads for the sale of birds of their own breeding … No more than 5 birds (2 times a year) …

• For active members of the club participating in exhibitions and other events, as well as members of the forum who help the development of our project, benefits will be provided for the sale of birds of their breeding.

In other cases, the “Commercial Seller” scheme is in effect

Conditions for placing advertisements are paid

Heading example: Moscow. I sell red kenar.

In the message about the bird (pair) it is obligatory to indicate the following data:

• Ring number (if any)

• Bird of your breeding (or where it was acquired)

• Sex of the bird

• Age of the bird (year of release)

• Color and breed

• Price (optional, you can specify a contractual, fixed price)

• Contacts (communication via personal, mail .. etc.)

• Conditions of transfer (specify the territorial location.Sale is carried out only in your city, or you can send to other cities.Self-pickup.Delivery conditions to other cities are discussed individually with the buyer.)

• Photo (required)

points, the topic will be deleted.

After a successful transaction, the author writes a message about closing the topic.

- Announcements Answers Views Last message OrniProm » Mon Jun 08, 2020 17:13 38 417745 OrniProm

Tue Oct 05, 2021 9:00

- Topics Answers Views Last post

- 0011 Tatyana1975 “Tue September 21, 2021 15:09 0 2489 Tatyana1975

V Sep 21, 2021 15:09 Pancakes of the Boil

Liya” Thu Apr 09, 2020 17:44 1 4214 Foam Spring

p.

Chu 30, 2020 20:44 I exchange an exchange a pair of cockatiels for a canary

Chu 30, 2020 20:44 I exchange an exchange a pair of cockatiels for a canary Mg2243 Moscow or Aprelevka

Zatochka » Mon Oct 01, 2018 13:35 1 528405, 2018 , 2017 13:43 3 6805 Gudvin

Wed Oct 11, 2017 22:27 We will exchange the male cockatiel for the kenar and the canary

Mg2243 » Wed Apr 05, 2017 20:59 0 5935 mg22493

Wed exchange the large cage for kenar

Mg2243 » Wed Sep 28, 2016 17:580011 Valermen » Tue Jun 28, 2016 11:40 1 6190 valermen

Wed Jul 06, 2016 14:09 I will accept new residents in flocks

Elena2016 » Wed Jun 08, 2016 1:13 0 5978 elena2016 12:00

Wed 13 Looking for a female canary for a kenar

Mg2243 » Fri Dec 04, 2015 23:04 4 7031 Academician

Mon Feb 01, 2016 22:00

Permissions

You Cannot start threads

you cannot reply to messages

you cannot edit your messages

you cannot delete your messages

you cannot add attachments

Who is currently at the conference

Who is browsing this forum: no registered users and guests: 1

You Can’t start topics

You Can’t reply to messages

You Can’t edit your posts

You Can’t delete your posts

You Can’t add attachments

We are looking for a female canary for a canary mg2243 Fri Dec 04, 2015 23 04 4 7031 Academician Mon Feb 01, 2016 22 00.

Forum. canaria. msk. en

08/26/2020 12:18:59

2020-08-26 12:18:59

Sources:

Http://forum. canaria. msk. en/viewforum. php? f=73

Once upon a time in an HFT company… / Sudo Null IT News

My personal trading history, all coincidences are random.

I started my HFT career at the Australian branch of one of the largest US trading companies as a C++ programmer. On the first day, I was greeted by an office with huge windows overlooking Sydney Harbor, one of which had “< 2ms” written in felt-tip pen. This has been a top priority for a dozen developers, but not yet for me. So...

Initial shock

One of the guys suggested the idea of trading options on the Australian Stock Exchange (ASX), or rather, option spreads and their combinations with mandatory hedging. He needed something that could handle a bunch of confusing trading rules and be integrated with the trading platform we used, which was called Orc.

However, Orc didn’t always calculate the price on demand, it often used caching. If the original parameters remained the same, Orc simply returned the price from memory, instead of recalculating it again. This platform was too slow to compete with Timber Hill’s own platform (now Interactive Brokers) or IMC’s Ord Liquidator, which was the fastest boxed system at the time. She seemed too shabby to compete with others in terms of performance, no matter what tricks I pulled with her. However, with a large multi-dimensional option price cache (missing values were obtained from it by simple interpolation), constantly updated in several threads by code written in C ++, suddenly we were able to make those transactions that were not available before.

When I changed the interest rate or volatility curve in Orc Trader, my price cache started filling up again. Of course, this decision was not original. I first read about option price caching in an old article a few years ago. As in a modern microprocessor with out-of-order execution, you can guess the next calculations that may still need to be done in the future. Market prices are discrete. Remember, the fastest calculations are the ones you don’t have to do. The next idea was that beating zero latency is hard, but not impossible. I drew this strange conclusion about predicting the future from the fact that the fastest message is the one that does not have to be sent. I think this is even more important.

In my opinion, the best architecture is no rigid architecture. This may sound a bit ridiculous, but it’s true in the case of HFT. Unstructured code instantly becomes legacy if you don’t pay attention to system architecture. Since, in fact, premature optimization is the foundation of everything, it’s best not to debunk common computer myths and let your competitors stumble over them.

My Orc Trader hack wasn’t a perfect solution, but it made a few people happy with trades that weren’t possible before. They even looked happy when they saw these deals in the reports with their own eyes. However, overall it was only a minor success. In the future, it turned into hundreds of manual rules for finding deals, recouping only the costs of the operator with its trading. But at least I had fun.

Focusing on “

< 2ms”

Let’s remember the “< 2ms” condition written on the window pane. I wrote an article suggesting a faster and more sophisticated way to achieve even lower latency. A team of three programmers, including me, had to implement it. The first choice fell on the Korean stock exchange. There was no need for price caching in this project, since the European option pricing model is not much more complicated than simple interpolation, even in multiple dimensions.

At this time, processors with a frequency of 2-3 GHz were just beginning to appear.

It turned out that I was assigned to a team that was not very cohesive, and as a new employee, I had to be careful. There were only three of us in the development department. One of the team members (who was actually an excellent programmer) apparently got tired and began to spend all his working time on games and forums about video accelerators.

But we had to somehow manage to overcome these two milliseconds. As it turned out, I needed to write more code than expected – I had to stay up late several times. “Mr. GPU” did the job of integration, while “Remote Dude” did nothing at all. As a result, our new system showed delays of just under five microseconds. I thought it was a huge success. However, this figure did not take into account network delays.

One of the other employees congratulated me. From him, I learned that the bulk of IT people (including him) considered this an impossible task. Apparently, they hoped that I would fail. The changes I brought were not widely accepted, but I received a small bonus without a significant increase in salary.

I used to expect to stay in this job for twenty years, especially after the dot-com bubble. But now it is clearly time for me to move on.

Looking for a new job

I contacted several HFT companies and shared my thoughts on what could be done. One good Dutch trading company listened to me very carefully, but offered nothing. Years later, I learned that their team started to implement something like what we talked about in the interview, the very next week after it. I heard that the approach was successful. They called it the “implied base method”, in which everything came down to predicting the theoretical price of a futures or underlying asset.

I then spoke to an Australian company with a team of about a dozen developers focused on trading on the ASX exchange. Their platform was basically even slower than Orc Trader, taking many milliseconds to calculate. I asked for a meeting with the head of the company, who was much more successful and much younger than me. He was one of the super-high paid guys whose income had to be declared under Australian law.

Their business didn’t look “totally clean” and he warned me that the money they earned abroad was not always legally easy to return to the parent company. Negotiations with this firm were a waste of time – I don’t want to be a black hat. Gray “Finding gaps in the rules is a fun game, as long as it’s ethical. However, these are the red lines we shouldn’t cross. There’s no fun in winning by cheating, but more importantly, your reputation matters.

I also liked one of the investment banks that I spoke to. It was a branch of a large Wall Street firm. I have already worked for several years in this kind of environment. The entry threshold seemed pretty low—they didn’t want to make money, they just wanted to generate turnover at no cost, so their finance department could serenade the affiliate. This seemed like a good option to me and I was sure they wouldn’t mind generating turnover as well as making extra profit. Profits rarely cause complaints.

The good thing about my previous firm was that they could lay off even earning employees. Someone broke the rules by making a few transactions that were not authorized. They made the company money, and I was impressed that they got fired anyway for violating the rules. This correct management position is extremely rare, especially in finance.

Then, quite unexpectedly, another possibility arose.

I once had lunch with a guy I knew in a computer science course at the University of Tasmania who was now working for ITG. He suggested that I speak to ITG as they were private traders. This was news to me – I thought they were just brokers. I met with their CEO, Asia Pacific, and he spoke in detail about their arbitrage platform, which works with USD and CAD denominated stocks. Then I met US CEO Ray Killian while he was on a trip to Australia. The meeting went well and there seemed to be no more barriers to the development of high frequency trading at ITG. The Asia Pacific CEO plus their chairman, who was also a board member of NYSE-listed ITG Inc., ended up taking the impromptu business plan and risk calculations to the US for a board meeting.

What happened next I don’t know – I was told three completely different stories over the next few years. According to one version, the board approved the business plan, but Killian played everything back. According to another version, some members of the board did not approve the project.

Birth of an HFT company

With an investment of AU$1.5 million, it’s time to start working alone with a laptop in the office again. I set up a few servers and workstations, installed 64-bit SuSE Linux, hired three programmers, and the clock for the investor-paid period started ticking. It turns out that I’m not a very good Linux system administrator. Soon I got tired of doing poorly admin tasks and entrusted them to a freelancer. Now there were four and a half of us. But it turned out that 64-bit SuSE Linux, especially on AMD processors with their Hypertransport bus, was not ready for prime-time workloads, so we returned to a 32-bit build of RedHat/CentOS.

Four months later, we took a look at the prospect. We had to choose whether to launch on our ASX or go to Korea. Three Korean exchanges, KSE, KOSDAQ and KOFFEX, were just merging into a single Korean exchange, KRX. We chose Korea, although both the business and technical environments there were more complex and risky. However, there were more features there too, plus simpler math in pricing models and a small number of tools promised a more lightweight codebase.

A funny thing happened at the same time. When creating a new system, you usually try to come up with some naming conventions to make your life easier. I decided to use ISO codes or part of them for standardization. However, due to the merger of Korean exchanges, no ISO code has yet been assigned for the new exchange. I contacted the responsible ISO team, who turned out to be the only excel spreadsheet guy sitting anywhere in Europe. He decided that the new code for the combined exchange would be XKOX.

In those early days in Korea, traders, even high-frequency ones, could not get direct access to the exchange. You had to go through the broker’s gateway and use their specific API to connect. There was no collocation at all. Among clients, there was a large difference in delays that was not controlled by the broker, simply due to different locations and interaction technologies. Futures and options were traded on the KOFFEX exchange. KOFFEX itself was located in Busan, a port city a little over three hundred kilometers from Seoul. Derivative contracts for the KOSPI 200 index had a small denomination, but a large lot size. Because of this, they were the most volatile derivatives in the world, with a tenfold lead over the rest.

By this point, I already knew that the networking stack introduced the most significant latency that I could manage in our new implementation. I found a hardware ethernet protocol converter in InfiniBand that introduced a latency of 3 microseconds. It was made in the form of a module that was connected to the TopSpin InfiniBand switch. AMD’s Hypertransport (HTX) bus, an alternative to PCI Express, was more modern, resulting in lower internal latency. I bought several Pathscale HTX Infinipath NICs and HTX capable motherboards (they were only in alpha versions at the time, for example one of them had serial number 0x0000045!), put all these motley parts into a large case and got an expensive, but an extremely fast networking stack that I was very pleased with.

Choosing a Broker

After that, we went to Seoul to find a broker and a place in the data center. I went with one of the investors, a man named Bubble, who then became our employee. At first he was torn between ITG and HFT, but later he became completely at our disposal, since both the CEO and the chairman of the Asia-Pacific region, as well as other ITG employees, were our investors. It was he who was instructed to book a hotel in Seoul. It turned out that he had chosen a motel with hourly rates, seduced by a very picturesque artistic description that obscured the true picture – rundown, dirty, rooms with peeling air conditioning, a virus-infected computer. Not a very good start. Several brokers stopped by and expressed surprise at our area. It’s awkward, but funny. The trip turned out to be quite productive, we made a stunningly incredible deal.

Good deal

Muppetz Securities offered us a DMA service. The big firm I left didn’t have direct access. Before that, I was looking at an HP/Compaq/Tandem system at an old job, as it was one of the ways to get into a particular broker’s internal network to get closer to the exchange. It cost about US$500,000 for a small box created through HP’s custom in-house application development program. Seductive, but not for a business that is living its last days. The DMA service offered to us now was implemented on the basis of the X.25 protocol, which was then innovative for me. This broker deal was quite expensive, but since real direct access was unheard of before, I signed the contract a few days later.

At that time, I met “Mr. Ree” from the local company RTS, who was passing through Seoul doing his own business. We helped each other in finding brokers in Korea. We used the RTS internal information system as a back-up store for our transactions so that shareholders can compare our data with those broadcast by independent vendors.

Back in Sydney, I was looking at all this expensive InfiniBand equipment. Now it was useless – we were going to switch to X.25. An unexpected but pleasant turn of events. Then I got a message from the broker Muppetz Securities that he was canceling our trade despite the contract already signed.

Some time later I learned that the Muppetz had gone to the big office where I used to work. X.25 was a very limited and rare resource. Why give it to some small startup HFT firm that isn’t even trading yet when you can go up a level and make a deal with real traders? Smart move, albeit unethical.

It turns out that saying “no” has weakened the brains of some brokers. I believe a lot of HFT firms have been thinking about how to get direct access.

I had no idea you could trade there. It turns out that this firm had a dusty, plain, air-conditioned room in an annex to the old KRX building. This old building, in contrast to the new building recently erected on campus, was connected by a corridor to the main tower, where the exchange engine was located several floors underground. This room was used as a place for emergency terminals. There was a small table in a narrow room with terminals with old CRT monitors. If the whole world were to end, employees would have to be sent there to enter the keys. This room was not adapted for a server infrastructure. Would we be interested in this little crappy room, which is the best they have to offer at the moment? I tried to hide my excitement by saying yes.

Muppetz’s X.25 solution was technologically faster, but the connection point was in a building outside the KRX campus, which added latency. Someone was going to pay a big premium for a solution that wasn’t as cool as the one we just came up with.

X.25 and technology

The X.25 exchange infrastructure platform was interesting. You could count on a T1 or E1 class line (the exchange had both options and used them alternately) from Koscom, KRX’s main technology and network provider. Within the line, virtual channels were allocated at 64 kilobits per second (kbps) according to the principle of time alternation. Interestingly, because of this interleaving, you essentially have parallel access to the entire channel at the same time. The broker has a limited number of lines, but many parallel (though slow) channels.

I did some testing and first bought X.25 NICs from a UK vendor. Popular enough to be worth mentioning, they seemed to be of industrial quality.

We set up our server rack in our dusty workroom. I came with hand-built servers in a bag. Communication lines have not yet been allocated for us. The channel to the exchange will appear a little later, but now we urgently needed market data to prepare and set up our infrastructure.

Soon the line from the exchange was connected to send orders with even more gigantic X.25 reciprocal connectors. We had modules for working with Postgresql (soon replaced by versions with flat files), a trading engine in C ++, a service for calculating volatility, etc. Instead of leased lines, as we initially agreed, we used regular Internet channels. We took three providers who promised geographic independence and assigned routes to provide redundancy. Much cheaper, higher throughput and more reliable than leased lines.

(Fal)start trading

Nine months after launch, we finished testing. No certification from the exchange was then required. At that time it really was the land of cowboys. We started trading – there were 85% executions on options! This means either you can’t price options correctly (and anyone can sell you contracts at bad prices), or you’re always first in line and you’re doing well. We had mostly the latter.

But we couldn’t make any money.

Our original plan was to simply buy juicy options and hedge them with futures. We spent almost a million dollars developing a platform for this, and the balance of half a million remained in the brokerage account as collateral for our trading, we could not touch it. We may have time to grab the option, but all profits will evaporate if we cannot hedge it properly. We were constantly working on it, and things improved little by little, but the problem was not completely solved.

Deriving an implied volatility (IV) curve has always been an art. In my old office, traders used a manual IV fitting process, and every five or ten minutes (or hour) they adjusted their curve to match the market.

We had another remarkable puncture. Mr. L has made some changes to the futures hedging mechanism that we have rolled out. The second we turned on the system, it instantly bought and sold on the market about a thousand lots of futures in a few seconds.

We tried, but still couldn’t make money. And these were no longer delays. The prices weren’t terrible. Our futures hedging mechanism was simply not efficient enough. We didn’t have the capital to “draw” the levels and use them to improve our financial performance. We tried to do passive market making on futures before trading options, but it didn’t matter. Nine months passed, this child’s gestation was complete, and sleeping in the office was less and less beneficial. It’s time to pray.

Zero Strategy

When you trade on the stock exchange, you are considered lucky if you get a part of the spread in your favor. At that time in Korea, ATM and lower options had a tick size of 0.01 pip. These 0.01 were worth about a dollar per contract. When trading a high-frequency robot with a series of options at once, if you are lucky, then you exit the transaction with an average of ten or twenty cents.

Then I remembered a conversation between one of the traders, Mr. B., and someone in the kitchen at the old firm (he ended up running the firm, by the way.) Mr. B. was asked if he bought on a good trading signal and made a profit , why doesn’t he immediately close the position? He replied that if everything was so simple, he would earn much more money than now. We had excellent latency with a good location and a direct X.25 link. The technology worked, the valuation model gave correct prices. Maybe we could do the impossible?

I spoke to the shareholders and told them that I needed another 25,000 AUD to get through the month and try something new.

We will live!

Our monthly trading income has become a healthy six digits. The Zero strategy worked. We increased the trading capital so that we could buy 500 or 1000 ATM options and then turn around and dump them back. There is no smart market making here. We were just being an aggressive taker.

Being a market taker can be more problematic than being a maker. As a market maker, you have to get out of the way of the market when it goes against you, but you have to be stoic enough not to get too flighty and lose a valuable place in line. As a rule, your price threshold, after which you need to run out of the order book to prevent a loss, is less than that of an aggressor who uses a trading advantage.

It was a kind of entertainment to watch the money appear in the bank account by itself after making a profit. It was a little surreal. We trade index options in Korea and Australian dollars appear in a bank account in Sydney.

Some of the money I made went into a home cluster in our newly rented 200 square meter office on Hunter Street, lots of small mini-ITX computers on a cheap hardware store shelf, RAM boards, ATX power supplies, and a network switch. Implied volatility modeling, backtesting, and the strategy itself have all improved with a few hundred additional cores.

The next step in our trading was the transition from the Zero strategy to a full-fledged hedging trading strategy. Instead of trying to hedge the position through futures, we turned to hedging with other options. We did not want to carry positions through the night, but were happy to hold them during the day. The Zero strategy kept a cumulative exposure of a few seconds throughout the day. The new strategy forced us to hold the position all day. This idea worked very well. About two-thirds of the KRX market consisted of options with low deltas and fairly static pricing. It was not unusual to see over a million lots of bids or asks in tiny options. However, buy these cheap options and it will be very difficult for you to dump them before the market closes. So we just focused on options with tighter spreads and larger deltas, tick size 0.01 with prices below 3.00. They accounted for about a third of the average market volume. We ended up growing to a typical 6-7% market share and sometimes over 10%.

Dealing with wires

The idea for the first significant hack came from looking at a twisted pair cable that was run through a window. The modems for the T1 and E1 lines transmitted this signal through clumsy connections leading to an even larger box, which was then connected via huge connectors to the serial cards. A little research and an obvious plan was born. I bought some new Sangoma cards with T1/E1 channels from NetOptics connected with twisted pair and installed this assembly in Korea. When I was asked what it was for, I answered that it was for monitoring the state of the line and measuring delays. This statement was technically correct, but incomplete.

The new Sangoma cards supported mixed mode, where the cards simply accept all the bits from the channel. I began to analyze them and understood what the flows looked like.

This was not unfamiliar territory. The Eurex exchange once provided a closed API – and it was hacked and the exchange protocol was reverse-engineered. After that, the official document on the technical regulation of membership on the exchange was adjusted so that it became a violation of the rules. Then this practice was stopped, but in Korea there was no such rule. Similarly, when ASX opened its first small co-location facility in Bondi, I noted that several client firms had 1U Dell servers installed, with no modems. Reverse engineering of the Nasdaq protocol wasn’t as uncommon as I had hoped – there are a lot of smart hackers out there.

Cut off and discarded

Things got even better in Korea. Now that I had bit by bit streaming (or at least byte by byte) I could see that the packets were wasting a lot of time on the wires. milliseconds. A common technique in network monitoring is slice, where you simply cut off the first part of a packet. I implemented this with my HDLC layer traversal code and now we were way ahead as we needed the bid and ask fields at the beginning of the quote packet. Save 100 bytes at 128Kbps and you’re ahead by 6.1ms. As the specification parameters grew and the KRX channels accelerated, our advantage decreased, but still remained acceptable. We were now submitting our orders before the input price packet was fully accepted.

Sometimes the exchange swapped virtual circuits, and we were left with a slow cable until I decrypted new numbers. The rest of the infrastructure also slowly improved. Now we had cables running not through the window, but through cable channels from the building’s main switch.

Another try

We struggled to find a new home. We focused on finding several points at once so that the business would be a little more sustainable. The X.25 protocol had not yet become common knowledge, but was no longer uncommon. Someone named Dr. S. came to our rescue and placed our equipment in the data center across the street. This broker was a little smarter and understood that if we can see the entire physical data stream, then we can potentially see the orders of other clients. He was right – technically we could, but we haven’t done it yet.

We set up the same infrastructure in a new location and kept looking. We noticed that the speed of market data on different sites was very different. We couldn’t get a GPS signal to synchronize the local clock over the network, but Korea used the CDMA mobile phone standard. Local manufacturer Endrun Technologies sold a nice little plastic box with which we were able to get a stable time signal. This device received a GPS signal inside CDMA and transmitted NMEA data plus (over another cable) pulses at ultra-precise intervals over the serial port. The CDMA specification promises jitter for precise time signals of no more than 10 microseconds, but in fact we got about one microsecond in Seoul. In comparison, one Canadian CDMA operator showed an accuracy of about 5 or 6 microseconds.

We ended up co-located in the KRX underground data center. Getting inside was quite difficult due to strict security. Having traveled a long way underground, I noticed that a cell phone signal was being picked up inside the data center. I put our CDMA receiver in a rack and it worked – we got the exact time from the intermittent cell signal until something inside burned out. Suspecting that I needed to put in a more efficient antenna, before my next trip to Seoul, I bought a white flexible antenna a meter long and soldered an SMA connector to it. When I went down to the underground bunker of the KRX data center and put the big white antenna on our rack, the guys from Koscom looked at me very suspiciously. I don’t know what they thought, but several other people over the years have mentioned that they saw my white antenna lying on top of the rack in the KRX.

Now we had the exact time at all points of presence and we needed to establish data exchange between them. We found that a few blocks away from campus, we were getting 300 microsecond latency between our locations over the city’s ten megabit Ethernet connection.

A little later, we set up market data at a new point in the annex to the KRX exchange building and the delays there turned out to be huge. This was the first time I ran into Citadel in Korea, I could tell by the timestamps on the network packets – they can tell you anything if you know how to listen to them. We asked to disable this channel, Koscom stopped the transmission and physically disconnected the line. After a month or two, we paid to reconnect, they turned on the same line without changing anything, and now it was one of the best.

Virtual channels for sending X.25 orders were 64 kbps each – this one is extremely slow. I thought we could use the same hack with Sangoma cards and started writing code that would send a packet with an order before it was fully formed in memory, which would save us milliseconds. After sending the order, we could turn the package into an invalid one, if suddenly the market situation had time to change and the order being sent was no longer needed. However, our small team was already very busy, and this task was not a priority, because our trading performance was already quite good. We learned more about implied volatility modeling and fine-tuned strategies.

Only change is permanent

Exchanges never stand still and KRX was no exception.

We wanted to try X.25 pre-shipping, but we didn’t have people available to spend a couple of months programming, especially since X.

Changes to TCP support on KRX turned out to be a simple mapping of X.

We saw that the new TCP-based architecture was going to shake up the market and potentially destroy much of the big brokers’ business. Good old X.25 was slow, but channel interleaving meant you had many parallel paths to send an order that could be shared. In the new world of TCP, there were a limited number of sessions, two or four, and all clients had to send their orders through these connections in turn, despite the seemingly many PIDs.

We went to Seoul to look around and were able to get some architectural diagrams that the Koscom provider kindly attached to the brokers’ racks. There was a backbone with a bandwidth of 622 Mbps, covering the entire city and having several branches that went to brokers.

The transition to TCP caused a lot of confusion for KRX and everything happened exactly as we expected. Major brokers such as Samsung Securities lost their market share as they were deceived by the exchange about their ability to serve their large customer base efficiently. Market data delays became common as the exchange was now accepting orders faster without a proportional increase in seed branch performance. But we’ve already done a good job of using stock timestamps to track delays in market data. Puts, calls and futures came through different channels and usually only one (and sometimes two) was delayed.

Working with the network in promiscuous mode was interesting and did not break the rules, because I don’t think their compilers knew about it at all. Switching to TCP/IP instead of X.25 required the use of firewalls, but we learned that some local traders were working around them. It was clearly against the rules and therefore we were not ready to do this. If you break a clearly written rule, you can be completely disconnected from the KRX exchange. Moreover, she did not have a reconnection procedure explicitly prescribed in the rules if you were once kicked out, so the decision may be completely final.

FPGA hack

We also managed to improve our market data hack. We were a small firm with a few people named Thomas. It’s incredible, but the eighteenth hired employee became our sixth Thomas. Part of the blame for this lay with me – I knew about the “Thomas problem” and, for fun, looked for graduate students with this name in different places. I noticed the new Thomas at UNSW in their NICTA group. He was preparing for his PhD and wrote an interesting paper on distributed shared memory on Linux, including a version for Itanium processors. I had come across this before, so I made a deal with him and he started working part-time as soon as he got his PhD.

Since we planned to enter other markets, we began to explore the FPGA more closely. Some time ago I almost started using FPGA instead of TopSpin’s Ethernet to InfiniBand converter. After tinkering with it for some time, I approached an FPGA company called Celoxica back in 2004 to find out about their technology. When we first started our HFT project, I asked Celoxica to come up with a solution to receive data over UDP.

Our new SANGOMA firmware worked great for us.